01. Achieving a top 5 position in the markets in which we operate through both organic and acquisition-led growth.

This strategic objective is driven by a recognition that profit pools in sub-Saharan African banking are often dispersed, whereby larger institutions with scale and advantageous funding costs attract more creditworthy customers and are able to innovate dynamically, while smaller institutions with less competitive funding costs are forced to accept a higher risk tolerance to participate in the market. Recognising these market characteristics, we intend to consolidate our positions in markets where we are sub-scale. To the extent that we cannot identify a credible path to obtaining a scale position in a given market, we will exit.

02. Delivering innovative products and services to our customers, including, in particular, the effective use of technology.

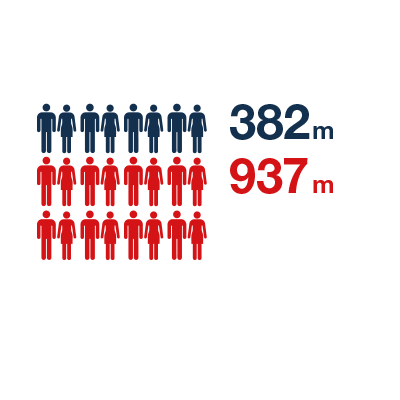

While there have been significant innovations in the provision of financial services in sub-Saharan Africa, most notably in Kenya with the success of M-Pesa and mobile money transfer, we believe that there is a substantial opportunity to leverage technology further, migrating from mobile money transfer to mobile banking and the provision of other value-added services. Effective and efficient front- and back-office technology creates the ability to more efficiently service existing customers, as well as increase financial inclusion and serve customers for whom financial institutions have been previously uninterested or unable to serve. Given this recognition, we expect to invest (both in terms of financial and human capital) in technology and will seek partnerships and alliances to order to leverage complementary competencies.

03. Establishing comprehensive and effective risk management and corporate governance policies and procedures across our network.

The effective pricing and management of risk is fundamental to sound banking. Given the markets in which we operate (or expect to operate) where there exist enhanced volatility combined with limitations on information availability, risk management and corporate governance are even more critical to sustainable growth. In addition to appropriate policies and procedures, we are focused on ensuring that there is a culture that ensures implementation and ongoing adherence.

04. Maintaining constructive relationships with the regulators in the markets in which we operate.

Sustainable growth in financial services sectors requires effective regulatory frameworks. Maintaining a transparent and candid dialogue with the regulators in the markets in which we operate is an important strategic objective. We aim to be both a model corporate citizen and a sounding board for supporting the evolution of regulatory frameworks for the future, particularly with respect to increasing regional integration and homogenisation of regulations across borders. We intend to continue to engage actively with the regulators in all the jurisdictions in which we operate.

05. Contributing positively to the communities in which we operate (most notably by strengthening financial systems and increasing financial inclusion)

In addition to leveraging technology to increase the number of people who have access to financial services, we intend to focus on supporting financial literacy and entrepreneurship programmes. On one end of the spectrum, we need to ensure that prospective customers, starting at a young age, have the right training to understand and manage their financial needs and become educated consumers of financial services products. On the other end, we intend to support burgeoning entrepreneurs in obtaining the training and tools they need to become the SME, national, regional and multi-national clients of the future.

06. Delivering differentiated, risk-adjusted returns to our investors.

Our strategy is to generate sustainable growth in earnings and attractive returns on equity and assets. We intend to deliver on this objective by way of a combination of the strategic objectives noted above: (i) obtaining market share, driving acquisition synergies, and attracting customers through expanded products and services to generate above-market growth; (ii) leveraging technology to serve customers efficiently and reduce our cost to income ratios, and ensuring that systems are in place to manage and price risk and ensure the sustainability of our growth and margins; and (iii) conveying a sense of mission and establishment of values whereby our employees remain focused on building a positive legacy.